Pricing questions that Beacon clients might ask include: What price(s) should we charge our customers? Are our prices too high, or too low? Can we raise our prices? How much can we charge for items within our portfolio of products or services? These are just some of the many questions that pricing research tackles, either wholly or in part. At Beacon Technology Partners, we use a variety of techniques to gauge price and value related issues.

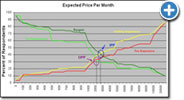

Van Westendorp

A company might have no idea what to charge customers for a new or improved product or service. If priced too expensively, demand for the product could drop sharply or never materialize, but if priced too cheaply, it could signal a lack of quality.

For clients with this particular issue to resolve, we have used a type of price modeling known as a van Westendorp analysis. Named after a well known Dutch economist who developed the technique, a "van Westendorp" analysis involves asking respondents four key price indicators:

- Too expensive - price is "so expensive that [respondent] would not consider buying it"

- Too inexpensive - price is "so inexpensive that [respondent] would feel the quality cannot be very good"

- Getting expensive - price is "beginning to get expensive so that it is not out of the question that [respondent] would have to give some thought to buying it"

- Bargain - price is "a great buy for the money". Data from respondents is then aggregated and plotted with cumulative frequency distributions functions. Two of the various intersection points have special meaning:

- Indifference price point (IPP) is the point at which the same proportion of respondents indicate that the price is a bargain as believe it is getting expensive

- Optimum price point (OPP) is the point at which the same proportion of respondents indicate that the price is too expensive as believe that the price is too inexpensive In particular, the range between the last two price point intersections is generally considered an acceptable range.

|

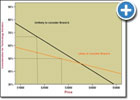

Gabor-Granger

Another situation arises when the price level needs to be balanced with market demand – with an eye toward knowing how price sensitive a market or product category is. For this, BTP uses Gabor-Granger (G-G) analysis. This approach asks each respondent their interest in purchasing a product or service at a given price. The price is then changed at random and the question is repeated. The prices and purchase inclinations are then aggregated across respondents and across price levels. G-G analysis enables us to calculate a demand function for various products and services, which then leads directly into the development of a revenue maximization function.

|

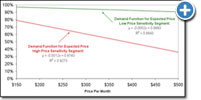

Conjoint Analysis

Conjoint analysis is also a popular technique for pricing research. Beacon often uses this method to gauge trade-offs between prices and various feature/functionality packages and options.

|

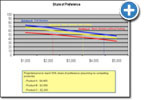

In-Person Focus Groups

Still another approach can include incorporating pricing questions into in-person focus groups, allowing the focus groups to turn into laboratories where different groups are exposed to various product features and asked about price levels they would (1) expect to be charged and (2) willing to pay. The difference between the two prices can be used as a harbinger of market success or resistance. |

Van Westendorp

Van Westendorp

In-Person Focus Groups

In-Person Focus Groups